*The 25 day moving average has crossed over the 200 signifying relative weakness. On the heels of Meredith Whitney's Neutral rating back in January, the stock has gone from $200 down to $147 and is hovering between $151 and $158. But now the party is over. Matt Taibbi has a great article in Rolling Stone which pulls back the curtain on GS bonus payouts and one wonders if the US government stops playing the stock market futures and municipalities likely will default on their debt this year and the consumer is still out of work, what will happen to GS profits? My guess is that either it will take a very long time for GS to reach back up to $200, let alone its high of around $248, or they will come up with some sophisticated security to sell to a desperate investing public. My money is on 1938 for obvious reasons: Wall Street has run out of ideas AND suckers! As Goldman Sachs shares continue their decline, so goes the stock market. Remember, the stock market is like the Titanic, it takes time for the effects of the turn to show. We already started that turn. The only question remaining is whether the turn will be large enough to save it from the iceberg up ahead.

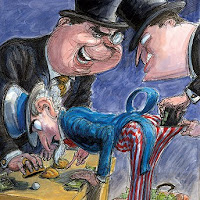

Wall Street's Bailout Hustle

Goldman Sachs and other big banks aren't just pocketing the trillions we gave them to rescue the economy - they're re-creating the conditions for another crash

MATT TAIBBI

On January 21st, Lloyd Blankfein left a peculiar voicemail message on the work phones of his employees at Goldman Sachs. Fast becoming America's pre-eminent Marvel Comics supervillain, the CEO used the call to deploy his secret weapon: a pair of giant, nuclear-powered testicles. In his message, Blankfein addressed his plan to pay out gigantic year-end bonuses amid widespread controversy over Goldman's role in precipitating the global financial crisis.

The bank had already set aside a tidy $16.2 billion for salaries and bonuses — meaning that Goldman employees were each set to take home an average of $498,246, a number roughly commensurate with what they received during the bubble years. Still, the troops were worried: There were rumors that Dr. Ballsachs, bowing to political pressure, might be forced to scale the number back. After all, the country was broke, 14.8 million Americans were stranded on the unemployment line, and Barack Obama and the Democrats were trying to recover the populist high ground after their bitch-whipping in Massachusetts by calling for a "bailout tax" on banks. Maybe this wasn't the right time for Goldman to be throwing its annual Roman bonus orgy.

Not to worry, Blankfein reassured employees. "In a year that proved to have no shortage of story lines," he said, "I believe very strongly that performance is the ultimate narrative."

Translation: We made a shitload of money last year because we're so amazing at our jobs, so fuck all those people who want us to reduce our bonuses.

Goldman wasn't alone. The nation's six largest banks — all committed to this balls-out, I drink your milkshake! strategy of flagrantly gorging themselves as America goes hungry — set aside a whopping $140 billion for executive compensation last year, a sum only slightly less than the $164 billion they paid themselves in the pre-crash year of 2007.

A year and a half after they were minutes away from bankruptcy, how are these assholes not only back on their feet again, but hauling in bonuses at the same rate they were during the bubble?

The answer to that question is basically twofold: They raped the taxpayer, and they raped their clients.

Full article here...

where is the hope & change when you need it?? Thought current admin. was going to do something about corporate "pillaging"? We learned that McCain wasn't going to do anything that day in DC- but we expected more from Mr. Obama. I am wondering when the American outrage is going to get loud enough to get some real change done...

ReplyDeleteThe outrage is that McCain is running for reelection and both sides of the isle could care less about the state of ordinary americans and that Obama is a tool.

ReplyDelete